27+ Estimate borrowing capacity

Common information needed to calculate your borrowing capacity. If youre self-employed theres an interesting hack to TRIPLE YOUR BORROWING POWERfrom 257000 to 856000.

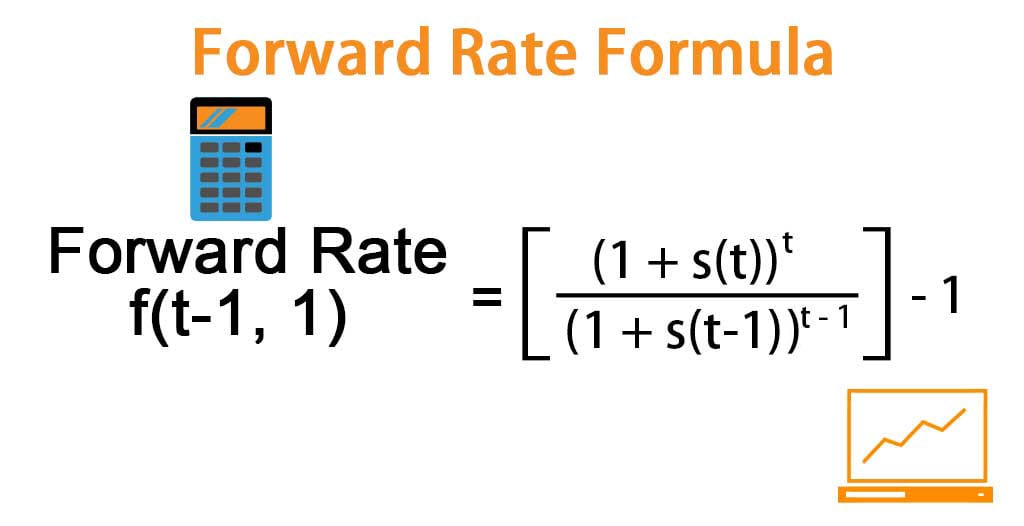

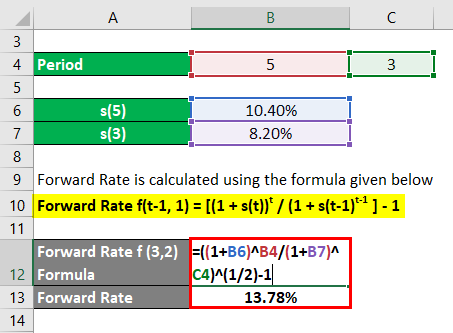

Forward Rate Formula Formula Examples With Excel Template

Calculate your borrowing capacity using this borrowing capacity calculator from Investment Real Estate.

. Calculate your borrowing capacity using this borrowing capacity calculator from Opes Property. No1 Place In Australia To Find The Perfect Property. When estimating how much you can afford to pay we recommend being slightly conservative with the amount that you use just to take into account.

Email Our Team email protected Request a call back. Comparison rate 2. Variable rate 1 472 pa.

How many applicants are applying for a mortgage. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration. 37 Calculate mortgage borrowing capacity Jumat 02 September 2022 Edit.

How much your annual salary is before tax. Compare home buying options today. Increase your borrowing power by reducing the number of additional features on your home loan extending your loan term and improving your credit score.

Calculate the Mortgage Offset of a property using this Mortgage Offset Calculator from Opes Property. This calculator helps you work out how much you can afford to borrow. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt repayments.

Understanding borrowing capacity and what you can do to improve it is the first step to owning property. Estimate how much you can borrow for your home loan using our borrowing power calculator. There are many factors that can affect your borrowing capacity however at the end of the day it does come down to your relationship with your broker and the lender.

Ad Receive 200 if you get a loan with a better rate elsewhere terms apply. Get your estimated borrowing capacity by entering information into our calculator and clicking the Get Estimate button. Enter your income and expenses to find out how much you could borrow for a home loan.

The Maximum Borrowing Capacity Calculator has been developed by HLM Calculators. The Domain and Range Calculator finds all possible x and y values for a given function. Even though there are plenty of templates and.

How does it work. Calculate your borrowing power. Borrowing capacity is the amount of money a lender is willing to loan you.

Whether you will be applying for the home loan by yourself or with someone else eg. Examine the interest rates. Most banks use one almost exactly the same as this.

Subtract your expenses from your income to. For a conventional loan your DTI ration cannot exceed 36. Usually this can be calculated as follows.

Then you will be required to enter the net salary income for each applicant and rent income if applicable. Borrowing capacity Self-financing capacity 3 or even 4 If you have to multiply by 3 or even 4 its because the banks consider that you can repay your loan over 3 or even 4 years. Square root of cos.

Complete the forms below to get view your estimated borrowing capacity. By shopping around or approaching a mortgage broker you may find you improve your borrowing capacity. This borrowing capacity calculator will allow you to estimate the amount that you likely will be able to borrow from a lending institute.

See if you prequalify for personal loan rates with multiple lenders. This assumes 1 a loan that is for owner occupier purposes. Thus as part of calculating your borrowing capacity it is also wise to ask your lender what is going to be the interest rate for your loan.

Get Offers From Top 7 Online Lenders. HLM Calculators is responsible for maintaining and updating the Maximum Borrowing Capacity Calculator. To calculate your borrowing capacity you may need to provide the following information to your lender.

View your borrowing capacity and estimated home loan repayments. Call us anytime 1300 617 277 or 0406 047 202. Skip to 5 min 41 sec.

Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency. For any further enquiries you can contact us directly and one of our customer care consultants will be more than happy to assist you. Based on our Flexible home loan with Member Package option annual fee 395 which currently offers a 369 pa.

Watch this video to see a real-life serviceability calculator in action. Purpose of the Loan. You can choose whether to apply as a single or joint.

Please enter values like 1000000 without commas. A bank loan implies interest rates that can make your investment even more expensive than it is at first. Therefore you have to relate your personal revenue and your.

Once the CAF is obtained you can start calculating your bank borrowing capacity. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. 27 Domain borrowing calculator Kamis 01 September 2022 Edit.

To estimate your borrowing capacity you should enter the number of borrowers ie. Buying or investing in a new property we have a variety of tools and calculators to. Ad Shortening your term could save you money over the life of your loan.

The Bank of Spain advises that the maximum. How much rental income you receive from properties. This calculator also shows how much you could borrow with a slightly larger payment per period.

Different lenders require different lending criteria. Ad Need a Business Loan. How to calculate borrowing power for your employment type.

Our calculator will assume a 20 down payment but there are plenty of financing options available some for as little as 3 down remember if you put less. You dont need to add your current rentaccommodation costs if youll be living in your new home. The repayment or debt capacity.

Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

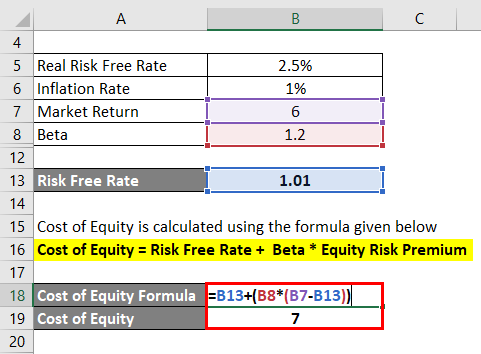

Risk Free Rate Formula How To Calculate Risk Free Rate With Examples

Effective Interest Rate Formula Calculator With Excel Template

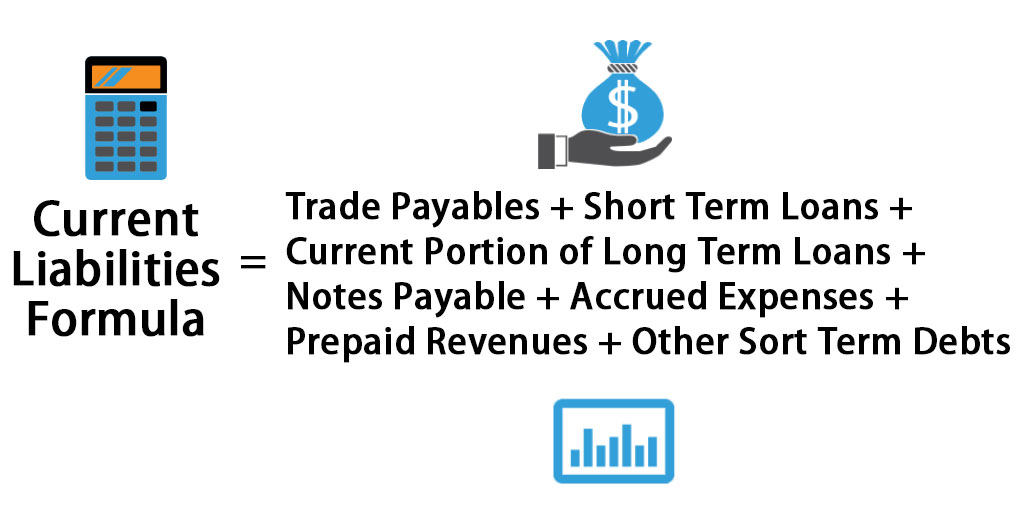

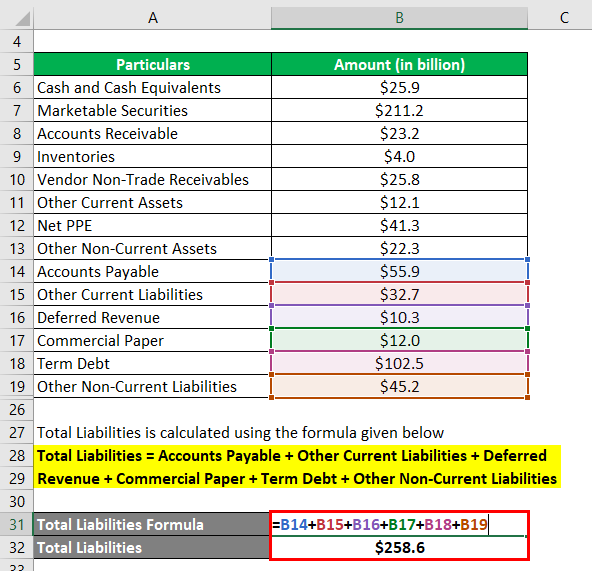

Current Liabilities Formula How To Calculate Current Liabilities

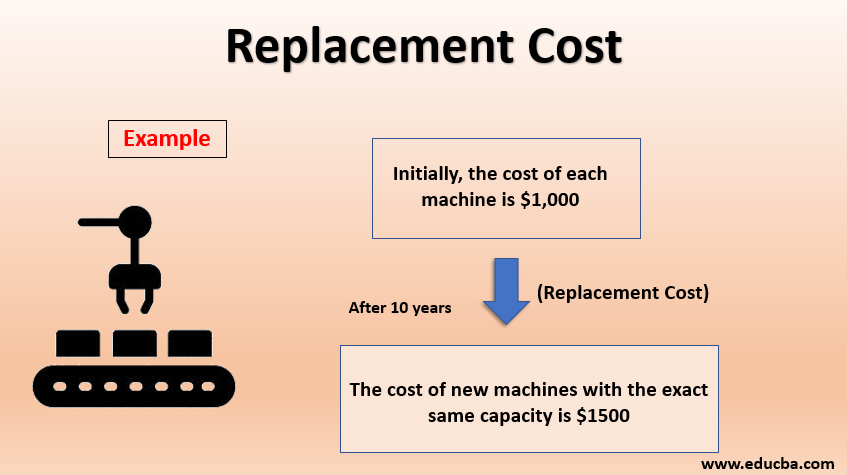

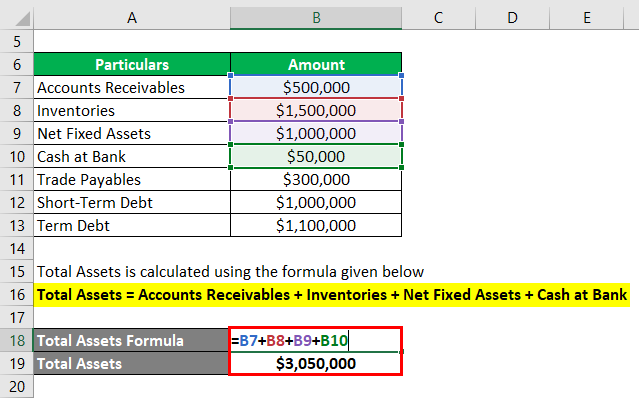

Replacement Cost How To Calculate The Replacement Cost Of A Firm

Forward Rate Formula Formula Examples With Excel Template

Net Worth Formula Calculator Examples With Excel Template

Net Worth Formula Calculator Examples With Excel Template

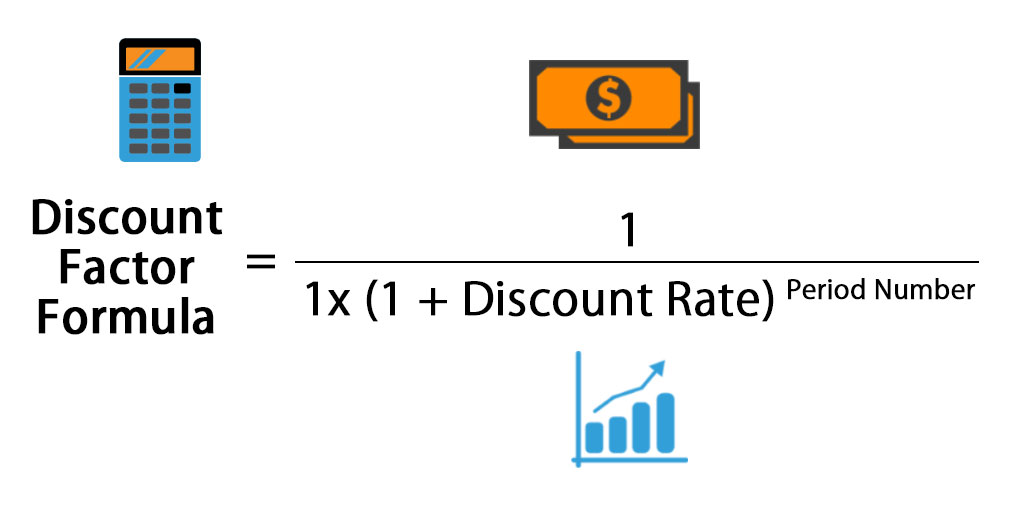

Discount Factor Formula Calculator Excel Template

Debt To Income Ratio Formula Calculator Excel Template

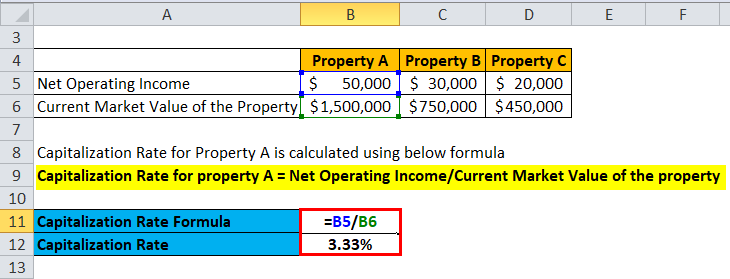

Capitalization Rate Formula Calculator Excel Template

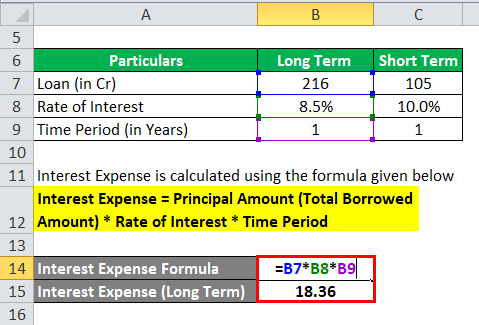

Interest Expense Formula Calculator Excel Template

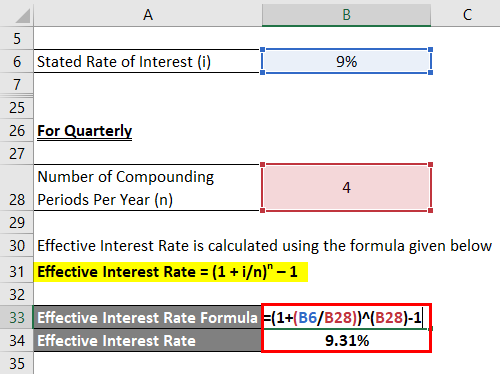

Effective Interest Rate Formula Calculator With Excel Template

Revenue Formula Calculator With Excel Template

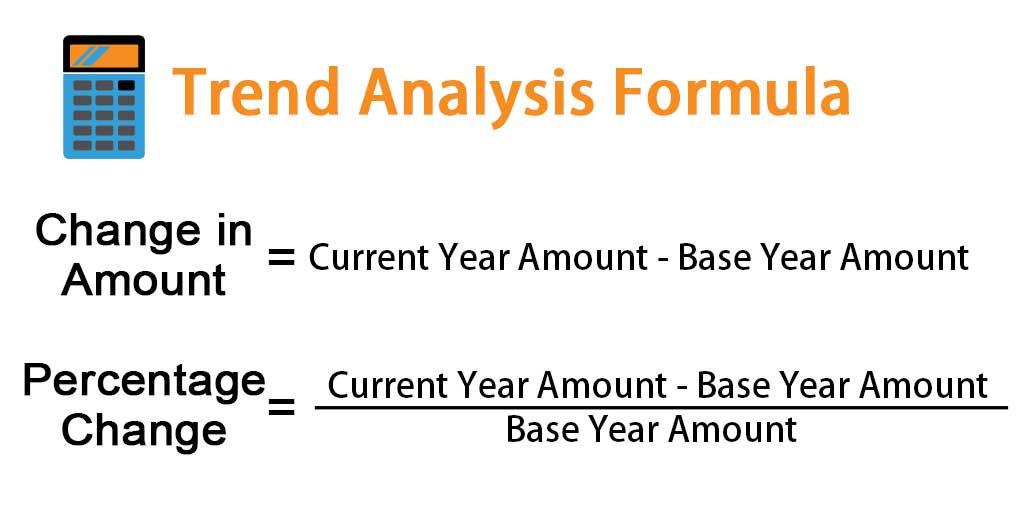

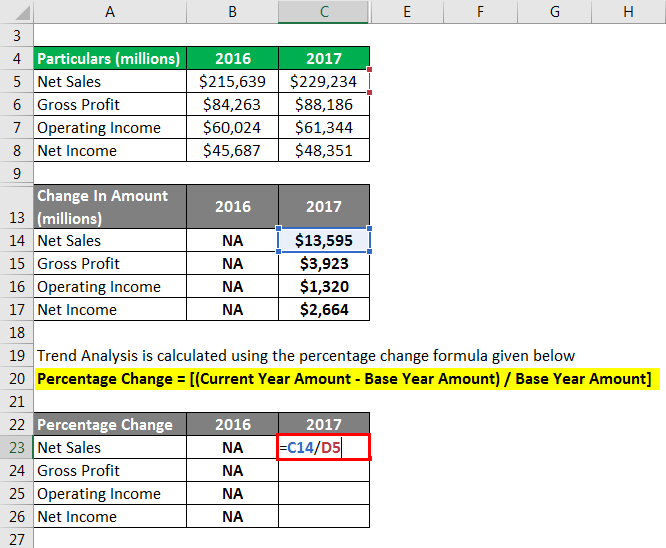

Trend Analysis Formula Calculator Example With Excel Template

Interest Expense Formula Calculator Excel Template

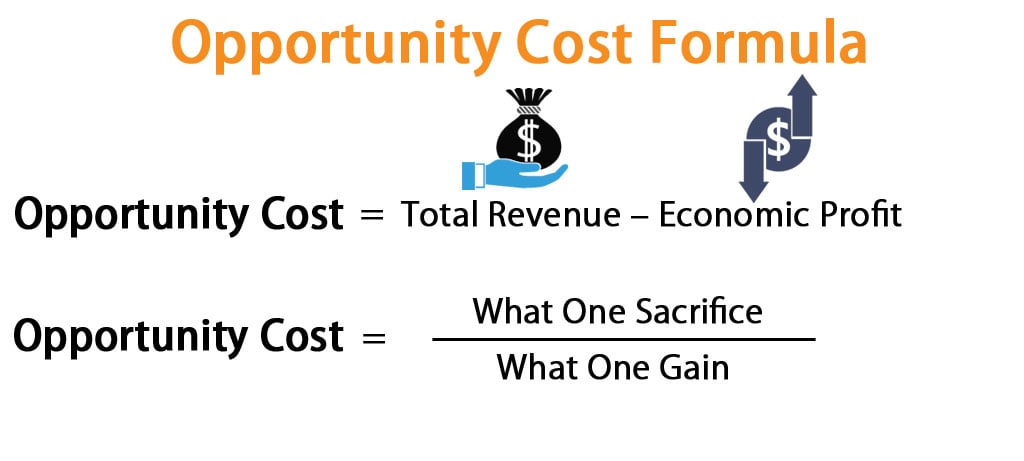

Opportunity Cost Formula Calculator Excel Template

Trend Analysis Formula Calculator Example With Excel Template